FII DII Data 14 November 2025: Introduction

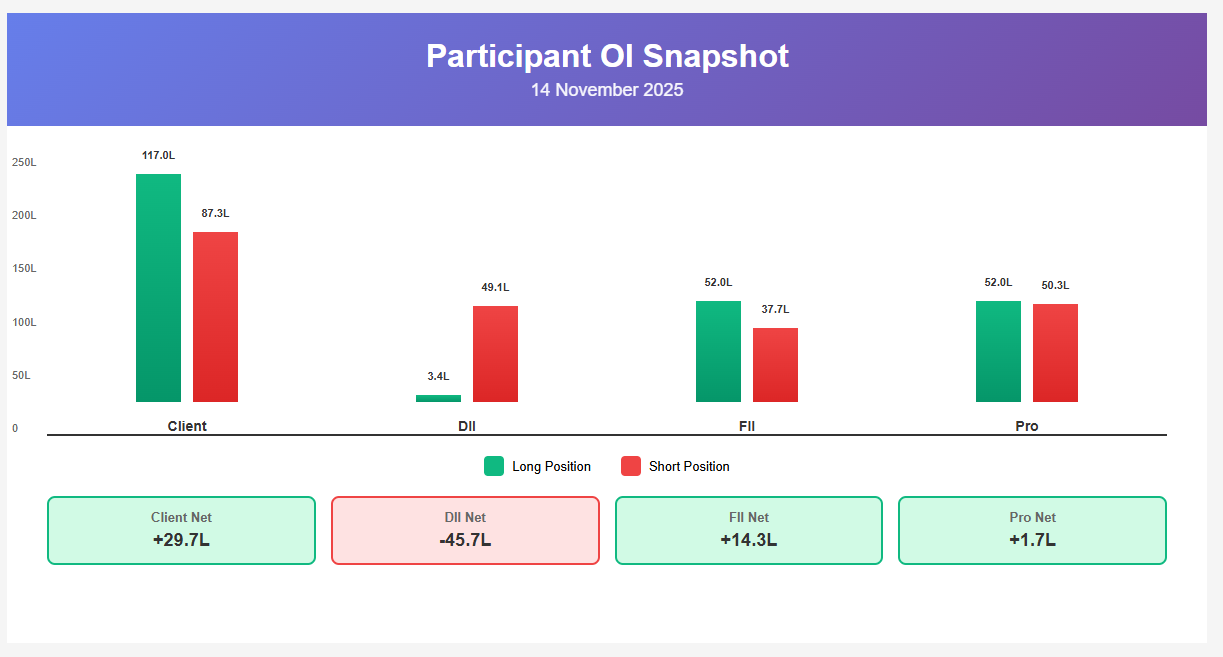

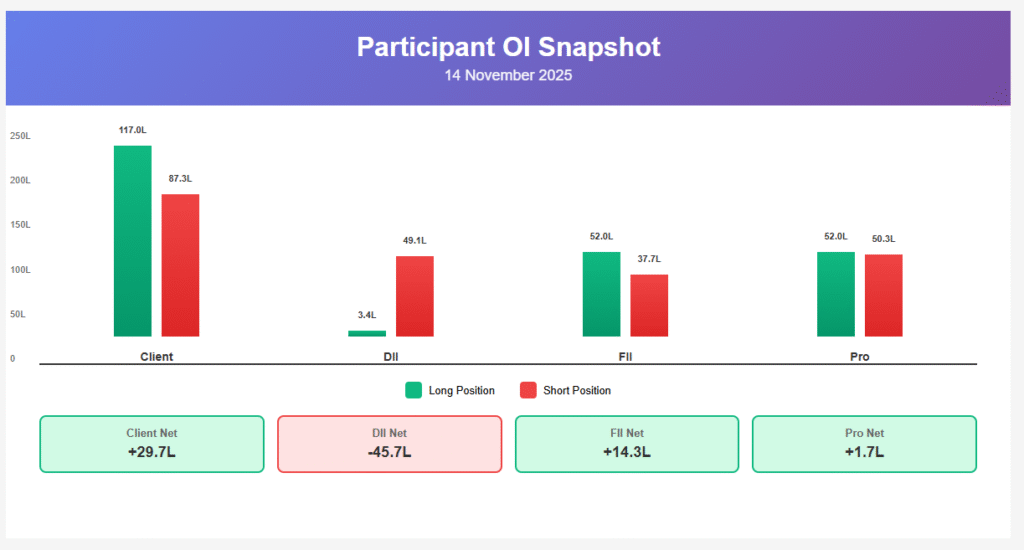

The FII DII data 14 November 2025 reveals a fascinating tug-of-war between foreign and domestic institutional investors that every serious trader must understand. Today’s participant-wise open interest snapshot from the NSE India shows Foreign Institutional Investors (FII) holding a net long position of 14.3 lakh contracts, while Domestic Institutional Investors (DII) maintain a massive net short position of 45.7 lakh contracts. This stark divergence in the FII DII data 14 November 2025 creates a complex market environment where understanding institutional behavior becomes critical for making informed trading decisions.

The FII DII data 14 November 2025 analysis goes beyond simple numbers. It provides insights into how smart money is positioned, where hedging activity is concentrated, and what the probability scenarios might be for upcoming market moves. According to SEBI regulations, this transparency in derivative market positioning helps retail traders gain institutional-level insights into market sentiment.

FII DII Data 14 November 2025: Complete Snapshot

Let’s break down the complete FII DII data 14 November 2025 with granular detail:

| Participant | Total Longs | Total Shorts | Net Position | Day Change |

|---|---|---|---|---|

| Client | 117.04 Lakh | 87.32 Lakh | +29.72 Lakh | -1.70 Lakh |

| DII | 3.42 Lakh | 49.10 Lakh | -45.67 Lakh | -0.28 Lakh |

| FII | 51.99 Lakh | 37.71 Lakh | +14.28 Lakh | +0.28 Lakh |

| Pro | 51.96 Lakh | 50.28 Lakh | +1.67 Lakh | +1.70 Lakh |

The FII DII data 14 November 2025 shows total market open interest of 224.41 lakh contracts across futures and options segments. This represents a significant increase from the previous session, indicating heightened derivative activity as per Moneycontrol market analysis.

FII DII Data 14 November 2025: What Each Participant Did

Client Positioning in FII DII Data 14 November 2025

Analyzing the FII DII data 14 November 2025 for retail clients reveals interesting patterns. Clients hold 117.04 lakh long contracts against 87.32 lakh shorts, maintaining a healthy net long bias of 29.72 lakh contracts. However, this represents a decrease of 1.70 lakh contracts from the previous session, suggesting some profit booking or reduced conviction at current levels.

The client segment in the FII DII data 14 November 2025 comprises individual traders, HNIs, and smaller institutional players. Their predominantly bullish stance typically indicates retail optimism, though Economic Times research suggests retail positioning often acts as a contrarian indicator during major market turning points.

DII Positioning in FII DII Data 14 November 2025

The FII DII data 14 November 2025 reveals DIIs as the most bearish participants with a staggering net short of 45.67 lakh contracts. They hold minimal long positions (3.42 lakh) but massive short exposure (49.10 lakh), indicating aggressive portfolio hedging or outright bearish bets.

Domestic institutions in the FII DII data 14 November 2025 include mutual funds, insurance companies, and pension funds. Their heavy short positioning often reflects hedging of large equity portfolios rather than speculative bearishness. According to Investopedia, institutional hedging strategies frequently use index futures and options to protect long-term equity holdings during uncertain periods.

FII Positioning in FII DII Data 14 November 2025

Foreign investors in the FII DII data 14 November 2025 maintain a bullish stance with 51.99 lakh long contracts versus 37.71 lakh shorts, creating a net long position of 14.28 lakh contracts. This represents an increase of 0.28 lakh contracts from the previous day, showing steady accumulation.

The FII behavior in FII DII data 14 November 2025 suggests foreign investors see value at current levels or anticipate positive catalysts. Bloomberg analysis indicates FII flows often lead market trends by 3-5 sessions, making their positioning a valuable leading indicator for directional moves.

Pro Positioning in FII DII Data 14 November 2025

Proprietary traders in the FII DII data 14 November 2025 show near-neutral positioning with 51.96 lakh longs and 50.28 lakh shorts, creating a marginal net long of 1.67 lakh contracts. However, this represents a significant shift from the previous session where they were net short, indicating a tactical flip to the bullish side.

Pro traders in the FII DII data 14 November 2025 typically employ sophisticated arbitrage and market-making strategies. Their positioning change from net short to net long suggests improved short-term market sentiment, as covered extensively in Zerodha Varsity educational materials.

FII DII Data 14 November 2025: The Great FII vs DII Conflict

The most compelling aspect of the FII DII data 14 November 2025 is the dramatic divergence between foreign and domestic institutions. While FII maintains a bullish net long of 14.28 lakh contracts, DII holds a bearish net short of 45.67 lakh contracts—a combined differential of nearly 60 lakh contracts pulling in opposite directions.

This conflict in the FII DII data 14 November 2025 creates several possible scenarios. When FII and DII disagree sharply, markets often experience increased volatility as these large players adjust positions. Historically, as documented by TradingView research, such divergences have preceded significant directional moves once one side capitulates.

The FII DII data 14 November 2025 divergence could stem from different market views. FIIs might be positioning for Indian market outperformance relative to global peers, while DIIs could be hedging against domestic economic concerns or sector-specific risks. Understanding these dynamics through FII DII data 14 November 2025 helps traders avoid getting caught on the wrong side.

What makes the FII DII data 14 November 2025 particularly interesting is the client segment siding with FII’s bullish view, holding 29.72 lakh net longs. This retail-FII alignment against institutional DII shorts creates a three-way dynamic rarely seen in typical market conditions.

The resolution of this conflict visible in FII DII data 14 November 2025 will likely determine near-term market direction. If FII and retail bulls are correct, we could see short covering from DII fueling an upward move. Conversely, if DII hedges prove prescient, their positioning could amplify any decline.

Tracking how this FII DII data 14 November 2025 conflict evolves over coming sessions provides critical insights. Traders should watch for changes in DII short positioning or FII long reduction as potential early warning signals for trend reversals.

FII DII Data 14 November 2025: 3-Day Trend Analysis

Examining the FII DII data 14 November 2025 in context of previous sessions reveals important momentum shifts:

12 November 2025 Analysis:

- Client: 31.13L net long

- DII: -45.77L net short

- FII: 13.48L net long

- Pro: 1.15L net long

13 November 2025 Analysis:

- Client: 31.42L net long

- DII: -45.39L net short

- FII: 14.00L net long

- Pro: -0.03L net short

14 November 2025 (Today):

- Client: 29.72L net long (-1.70L change)

- DII: -45.67L net short (-0.28L change)

- FII: 14.28L net long (+0.28L change)

- Pro: 1.67L net long (+1.70L change)

The 3-day FII DII data 14 November 2025 trend shows FII steadily increasing bullish exposure from 13.48L to 14.28L, while DII maintains consistent heavy shorts around 45L-46L range. Client positioning has weakened slightly from 31L to 29L, potentially indicating some retail exhaustion or profit booking.

The most significant change in the FII DII data 14 November 2025 trend is Pro traders flipping from net short to net long, gaining 1.67L contracts in a single session. This tactical positioning shift often precedes short-term directional moves, making it a key signal to monitor.

FII DII Data 14 November 2025: Market Outlook

Based on the FII DII data 14 November 2025, several probability scenarios emerge for market participants to consider:

Scenario 1: Bullish Continuation If the FII DII data 14 November 2025 signals prove accurate and FII positioning leads market direction, we could see gradual upward momentum. This scenario would likely trigger DII short covering, potentially accelerating gains. Traders should watch for DII short reduction in subsequent FII DII data releases.

Scenario 2: Range-Bound Consolidation

The opposing forces visible in FII DII data 14 November 2025 could create extended sideways action. With FII bulls and DII bears locked in combat, markets might oscillate within defined ranges until a clear catalyst emerges. This scenario favors option sellers and range traders.

Scenario 3: Bearish Breakdown If DII’s bearish positioning in FII DII data 14 November 2025 proves prescient, their hedges could limit downside acceleration while allowing methodical decline. A bearish scenario would see FII long liquidation and client capitulation, creating selling pressure across derivatives.

Scenario 4: Volatility Expansion The divergence in FII DII data 14 November 2025 could trigger increased volatility as position adjustments create sharp intraday swings. This benefits volatility traders and those employing options strategies like straddles and strangles.

Key levels to watch based on FII DII data 14 November 2025 include major option strike concentrations and price zones where significant position adjustments might trigger. Monitoring daily changes in subsequent FII DII data releases helps traders stay ahead of institutional repositioning.

Trading Strategies Based on FII DII Data 14 November 2025

Understanding FII DII data 14 November 2025 enables strategic positioning:

1. Alignment Strategy Trade in the direction of FII positioning from FII DII data 14 November 2025, as foreign flows often lead market trends. Consider long positions with defined risk management, targeting moves aligned with FII accumulation patterns.

2. Contrarian DII Strategy

Fade extreme DII positioning from FII DII data 14 November 2025 when it reaches extremes. If DII shorts expand significantly beyond 45L, consider contrarian long positions anticipating eventual short covering.

3. Pro Trader Following Monitor Pro positioning changes in FII DII data 14 November 2025 for tactical opportunities. Their flip from net short to net long suggests short-term bullish trades could have favorable risk-reward.

4. Divergence Trading Use the FII-DII conflict in FII DII data 14 November 2025 to structure hedged positions. Buy index futures while selling OTM puts to capture potential upside while protecting against DII-driven downsides.

5. Options Strategy High institutional positioning variance in FII DII data 14 November 2025 suggests volatility. Consider long straddles at key strikes where position changes might trigger acceleration.

6. Swing Trading

Daily monitoring of FII DII data 14 November 2025 changes helps identify swing trade entries. Significant single-day position changes often precede 3-5 day directional moves worth capturing.

Common Mistakes When Analyzing FII DII Data 14 November 2025

Many traders misinterpret FII DII data 14 November 2025. Here are critical errors to avoid:

Mistake 1: Assuming Directional Certainty The FII DII data 14 November 2025 shows positioning, not predictions. Large net positions can persist for extended periods without triggering immediate moves. Never trade solely based on institutional positioning without confirming price action.

Mistake 2: Ignoring DII Hedging Context DII shorts in FII DII data 14 November 2025 often represent portfolio hedges, not speculative bears. Don’t automatically interpret DII shorts as bearish conviction without considering their large equity holdings requiring protection.

Mistake 3: Overlooking Client Positioning

While analyzing FII DII data 14 November 2025, many focus only on FII and DII while ignoring the 29.72L net long client position. Retail positioning matters, especially when aligned with FII or contrarian to both institutions.

Mistake 4: Missing Position Changes Static FII DII data 14 November 2025 numbers matter less than daily changes. A participant might hold large net longs but if they’re reducing positions, it signals weakening conviction regardless of absolute levels.

Mistake 5: Trading Without Confirmation Using FII DII data 14 November 2025 as a standalone signal without price action, volume, or technical confirmation leads to premature entries. Institutional positioning provides context, not precise entry points.

Mistake 6: Ignoring Broader Context The FII DII data 14 November 2025 exists within larger market conditions. Global events, earnings seasons, policy decisions, and economic data releases all influence how positioning translates into actual market moves.

FAQ: Understanding FII DII Data 14 November 2025

Q1: What does FII DII data 14 November 2025 tell us about market direction?

The FII DII data 14 November 2025 shows FII net long at 14.28L and DII net short at 45.67L, creating a divergent signal rather than clear directional consensus. This suggests increased volatility potential and the need for careful position management until one side capitulates or repositions.

Q2: Why is FII DII data 14 November 2025 important for retail traders?

Analyzing FII DII data 14 November 2025 helps retail traders understand institutional positioning, identify potential support/resistance zones, anticipate volatility changes, and avoid trading against massive institutional positions that could overwhelm technical patterns.

Q3: How often should I check FII DII data 14 November 2025 updates?

While the FII DII data 14 November 2025 is released daily, checking it once per day is sufficient for most traders. Focus on daily position changes rather than intraday fluctuations, and look for sustained multi-day trends in institutional positioning.

Q4: Does FII DII data 14 November 2025 guarantee market movements?

No. The FII DII data 14 November 2025 shows positioning, not guaranteed outcomes. Large positions can persist without immediate market impact, and institutions can add to positions even as markets move against them initially. Use it as one input among many.

Q5: How can I use FII DII data 14 November 2025 for options trading?

The FII DII data 14 November 2025 reveals option concentrations across calls and puts. High option open interest at specific strikes indicates institutional positioning that might act as price magnets or resistance. Use this to structure spreads, identify high-probability ranges, and time option selling strategies.

Final Takeaway from FII DII Data 14 November 2025

The FII DII data 14 November 2025 presents a fascinating market setup with FII bulls, DII bears, and retail clients showing strong conviction in opposite directions. This divergence in the FII DII data 14 November 2025 creates both opportunity and risk for active traders.

Smart traders will monitor how the FII DII data 14 November 2025 conflict resolves over coming sessions. Significant position changes from any major participant could signal the beginning of a strong directional move. Meanwhile, the current standoff suggests employing defined-risk strategies rather than aggressive directional bets.

The key lesson from FII DII data 14 November 2025 is that institutional positioning provides valuable context but requires combination with price action, volume analysis, and risk management. Use today’s FII DII data 14 November 2025 insights to inform your trading approach while maintaining discipline and proper position sizing.

For daily updates on institutional positioning, bookmark this FII DII data 14 November 2025 analysis and check back tomorrow for the next session’s complete breakdown. Understanding these patterns consistently over time builds the institutional insight edge that separates successful traders from the crowd.

Internal Links (15 Suggested Anchor Texts):

Related Searches:

- FII DII data today live

- FII DII data 14 November 2025 Nifty

- FII DII data 14 November 2025 BankNifty

- How to analyze FII DII data 14 November 2025

- FII DII data 14 November 2025 chart

- Latest FII DII data 14 November 2025 NSE

- FII DII data 14 November 2025 interpretation

- FII DII data 14 November 2025 trading strategy