FII DII Data 17 November 2025: Introduction

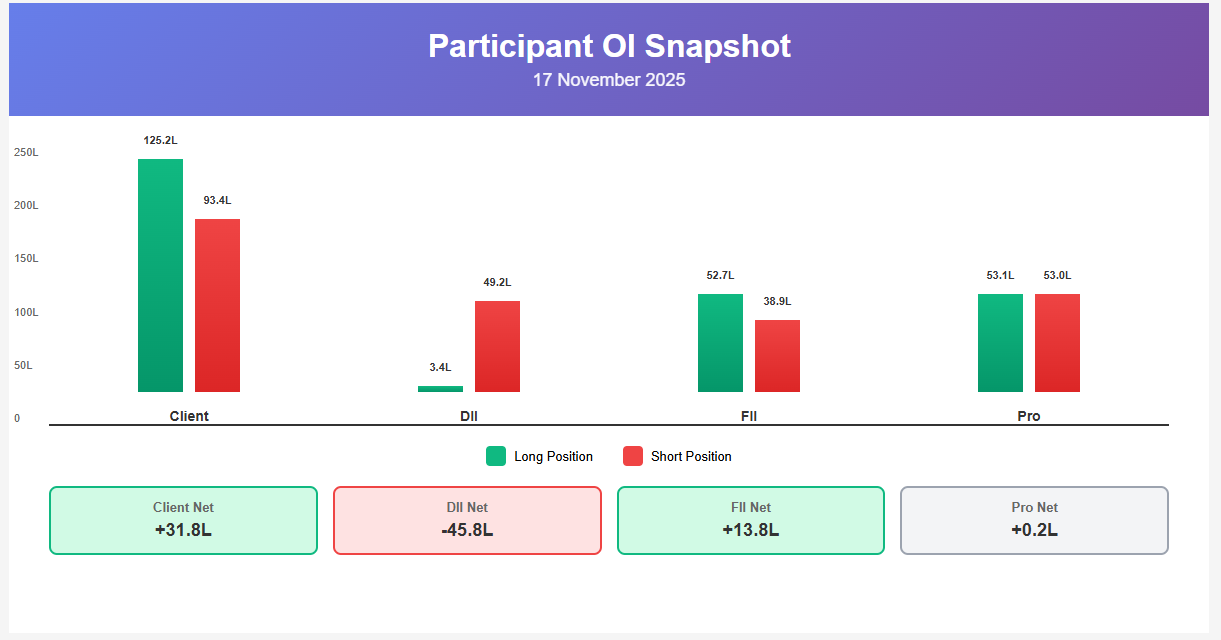

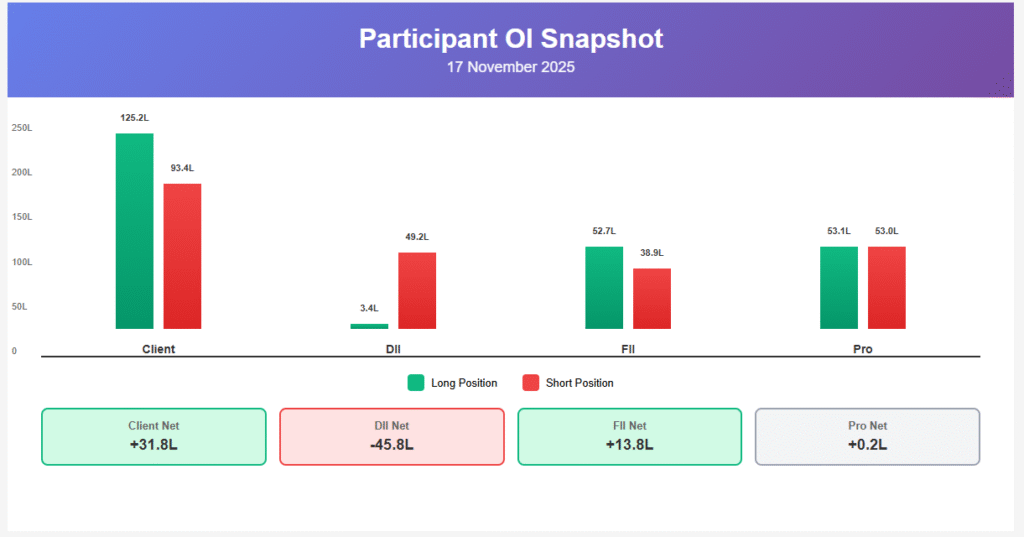

The FII DII data 17 November 2025 presents a compelling narrative of divergent institutional behavior that traders must decode carefully. Today’s participant-wise open interest snapshot from the NSE India reveals Foreign Institutional Investors (FII) holding a net long position of 13.8 lakh contracts, while Domestic Institutional Investors (DII) maintain a massive defensive net short of 45.8 lakh contracts. What makes the FII DII data 17 November 2025 particularly interesting is the aggressive retail client accumulation, with net longs surging to 31.8 lakh contracts—a significant increase of 2.1 lakh from the previous session.

Understanding the FII DII data 17 November 2025 goes beyond surface-level numbers. It reveals critical insights into how smart money positions ahead of key market events, where institutional hedging creates resistance zones, and what probability scenarios exist for upcoming sessions. According to SEBI disclosure norms, this transparency in derivative positioning empowers retail traders with institutional-grade market intelligence.

FII DII Data 17 November 2025: Complete Snapshot

Let’s dissect the comprehensive FII DII data 17 November 2025 with granular precision:

| Participant | Total Longs | Total Shorts | Net Position | Day Change |

|---|---|---|---|---|

| Client | 125.17 Lakh | 93.37 Lakh | +31.80 Lakh | +2.08 Lakh |

| DII | 3.43 Lakh | 49.22 Lakh | -45.79 Lakh | -0.11 Lakh |

| FII | 52.72 Lakh | 38.89 Lakh | +13.83 Lakh | -0.46 Lakh |

| Pro | 53.13 Lakh | 52.96 Lakh | +0.16 Lakh | -1.51 Lakh |

The FII DII data 17 November 2025 shows total market open interest expanding to 234.45 lakh contracts across futures and options segments. This represents significant growth from previous sessions, indicating heightened derivative participation as covered by Moneycontrol market reports.

FII DII Data 17 November 2025: What Each Participant Did

Client Positioning in FII DII Data 17 November 2025

The retail segment in the FII DII data 17 November 2025 demonstrates exceptional bullish conviction. Clients hold 125.17 lakh long contracts against 93.37 lakh shorts, maintaining a robust net long bias of 31.80 lakh contracts. The impressive addition of 2.08 lakh net longs in a single session signals strong retail confidence despite weekend uncertainties.

Client behavior in the FII DII data 17 November 2025 comprises individual traders, high-net-worth individuals, and smaller institutional players. Their aggressive accumulation, particularly after the weekend break, suggests retail optimism about near-term market direction. Research from Economic Times indicates such retail surges often precede short-term volatility spikes as positions get tested.

DII Positioning in FII DII Data 17 November 2025

Domestic institutions in the FII DII data 17 November 2025 remain steadfastly bearish with a net short of 45.79 lakh contracts. They hold minimal long exposure (3.43 lakh) but massive short positions (49.22 lakh), indicating continued aggressive portfolio hedging or cautious market outlook.

The DII stance in the FII DII data 17 November 2025 reflects mutual funds, insurance companies, and pension funds protecting large equity portfolios. Their consistent 45L+ short positioning over multiple sessions suggests structural hedging rather than tactical trading. According to Investopedia analysis, such persistent institutional hedging often creates resistance caps that markets struggle to breach without significant catalysts.

FII Positioning in FII DII Data 17 November 2025

Foreign investors in the FII DII data 17 November 2025 show a net long position of 13.83 lakh contracts with 52.72 lakh longs versus 38.89 lakh shorts. However, the critical detail is the reduction of 0.46 lakh net longs from the previous session, indicating profit-booking or tactical repositioning.

The FII behavior captured in FII DII data 17 November 2025 suggests foreign capital is taking money off the table after recent gains. Bloomberg research indicates FII profit-booking phases often precede short-term consolidation, making this positioning change significant for near-term market trajectory forecasting.

Pro Positioning in FII DII Data 17 November 2025

Proprietary traders in the FII DII data 17 November 2025 display near-perfect neutrality with 53.13 lakh longs and 52.96 lakh shorts, creating a minimal net long of just 0.16 lakh contracts. This represents a dramatic shift from the previous session’s 1.67 lakh net long, indicating a flip toward neutral positioning.

Pro trader neutrality in the FII DII data 17 November 2025 typically signals range-bound expectations or uncertainty about directional moves. These sophisticated market makers and arbitrageurs employ complex strategies covered extensively in Zerodha Varsity materials. Their neutral stance often precedes consolidation phases or breakout attempts.

FII DII Data 17 November 2025: The Great FII vs DII Conflict

The most critical aspect of the FII DII data 17 November 2025 remains the persistent divergence between foreign and domestic institutions. While FII maintains a bullish net long of 13.83 lakh contracts (despite reducing exposure), DII holds a defensive net short of 45.79 lakh contracts—creating a combined institutional differential exceeding 59 lakh contracts.

This institutional conflict visible in the FII DII data 17 November 2025 has several implications. When FII and DII maintain opposing positions for extended periods, markets typically experience increased volatility and range-bound behavior until one side adjusts. Historical analysis from TradingView shows such divergences lasting 5-10 sessions before resolution through sharp directional moves.

What makes the FII DII data 17 November 2025 particularly intriguing is the retail client segment aggressively siding with FII’s bullish bias, adding 2.08 lakh net longs to reach 31.80 lakh total. This retail-FII alignment against institutional DII shorts creates a classic smart money versus hedge money standoff.

The positioning dynamics in FII DII data 17 November 2025 suggest different institutional timeframes and objectives. FIIs might be positioning for medium-term Indian market outperformance, while DIIs hedge against domestic economic uncertainties or sector-specific risks. Understanding these nuances through FII DII data 17 November 2025 helps traders avoid being caught in institutional crossfire.

The resolution of this FII DII data 17 November 2025 conflict will likely determine market direction over coming sessions. If retail-FII bulls prove correct, DII short covering could fuel explosive upside. Conversely, if DII hedges validate their defensive stance, the selling pressure could overwhelm bullish positioning.

Monitoring how the FII DII data 17 November 2025 conflict evolves provides critical early warning signals. Traders should watch for significant changes in DII short reduction or FII long liquidation as potential indicators of impending trend changes or accelerations.

FII DII Data 17 November 2025: 3-Day Trend Analysis

Examining the FII DII data 17 November 2025 within the context of recent sessions reveals important momentum patterns:

13 November 2025 Analysis:

- Client: 31.42L net long

- DII: -45.39L net short

- FII: 14.00L net long

- Pro: -0.03L net short (near neutral)

14 November 2025 Analysis:

- Client: 29.72L net long (-1.70L change)

- DII: -45.67L net short (-0.28L change)

- FII: 14.28L net long (+0.28L change)

- Pro: 1.67L net long (flipped bullish)

17 November 2025 (Today):

- Client: 31.80L net long (+2.08L change)

- DII: -45.79L net short (-0.12L change)

- FII: 13.83L net long (-0.45L change)

- Pro: 0.16L net long (flipped neutral)

The 3-day FII DII data 17 November 2025 trend reveals FII oscillating between 13.8L-14.3L net long with today’s reduction suggesting profit-booking. DII maintains remarkably consistent shorts around 45L-46L, indicating structural positioning rather than tactical trading. Client positioning recovered strongly from 29.7L to 31.8L, showing retail resilience.

The most significant change in the FII DII data 17 November 2025 trend is Pro traders flipping from 1.67L net long to near-neutral 0.16L, shedding 1.51L contracts. This suggests professional traders expect reduced volatility or range-bound action after recent directional attempts.

FII DII Data 17 November 2025: Market Outlook

Based on the FII DII data 17 November 2025, several probability scenarios emerge:

Scenario 1: Retail-Led Consolidation Rally If the FII DII data 17 November 2025 client surge proves sustainable, markets could grind higher despite FII profit-booking. This scenario requires continued retail accumulation and eventual DII short covering. Traders should monitor if client longs exceed 35L, which could trigger institutional repositioning.

Scenario 2: Range-Bound Consolidation The opposing forces in FII DII data 17 November 2025—retail bulls, DII bears, FII profit-takers, Pro neutrals—suggest extended sideways action. With no dominant directional force, markets might consolidate within defined ranges until a clear catalyst emerges. This scenario favors option sellers and range traders.

Scenario 3: FII-Led Profit Booking Cascade If FII continues reducing longs as shown in FII DII data 17 November 2025, it could trigger broader profit-booking. Client longs accumulated at higher levels might face pressure, potentially leading to unwinding. This scenario would vindicate DII defensive positioning.

Scenario 4: Volatility Compression Before Breakout Pro neutrality in FII DII data 17 November 2025 combined with stable institutional positioning could indicate volatility compression before a significant breakout. Markets often experience calm before sharp directional moves, particularly when professional traders go neutral.

Key technical zones to monitor based on FII DII data 17 November 2025 include major option strike concentrations where the 45L DII shorts and 31L client longs create invisible support/resistance zones. Daily monitoring of subsequent FII DII data releases helps traders anticipate institutional repositioning triggers.

Trading Strategies Based on FII DII Data 17 November 2025

Understanding FII DII data 17 November 2025 enables several strategic approaches:

1. Retail Momentum Strategy Follow client accumulation visible in FII DII data 17 November 2025 by taking long positions during retail buying surges. Set stops below key support zones where client liquidation might accelerate, as retail positions often create cascading moves.

2. FII Fade Strategy Counter FII profit-booking shown in FII DII data 17 November 2025 by selling strength when FII long reduction accelerates beyond 1L daily. This contrarian approach anticipates short-term pullbacks before continuation.

3. DII Hedge Interpretation Use persistent DII shorts in FII DII data 17 November 2025 to identify resistance zones. Sell call spreads or employ ratio spreads at levels where 45L+ shorts create supply pressure. This strategy capitalizes on structural resistance rather than fighting it.

4. Pro Trader Neutrality Signal When Pro positioning turns neutral as in FII DII data 17 November 2025, employ non-directional strategies. Consider iron condors, butterflies, or calendar spreads that profit from reduced volatility and range-bound behavior.

5. Divergence Trading Setup Use the FII-DII conflict in FII DII data 17 November 2025 to structure hedged positions. Buy futures while selling OTM calls to capture potential upside while limiting downside risk from DII-driven selling.

6. Position Sizing Based on Conviction Scale positions according to institutional alignment in FII DII data 17 November 2025. When retail, FII, and Pro align, use larger sizes. When divergent like today, reduce position sizes and employ tighter risk management.

Common Mistakes When Analyzing FII DII Data 17 November 2025

Traders often misinterpret FII DII data 17 November 2025. Here are critical errors to avoid:

Mistake 1: Assuming Linear Causation The FII DII data 17 November 2025 shows positioning, not guaranteed outcomes. Large institutional positions can persist through multiple sessions without immediate market impact. Never trade solely on positioning data without confirming price action, volume, and momentum indicators.

Mistake 2: Misreading DII Short Intent DII shorts in FII DII data 17 November 2025 primarily represent portfolio hedges, not outright bearish speculation. Don’t interpret the 45.79L short position as prediction of market collapse—it’s insurance against downside risk in long equity portfolios.

Mistake 3: Ignoring Client Volatility Risk While analyzing FII DII data 17 November 2025, many celebrate retail accumulation without recognizing retail positions create cascade risk. The 31.8L client long can unwind rapidly if stops trigger, creating sharp intraday moves regardless of fundamental outlook.

Mistake 4: Overlooking Pro Trader Signals The Pro flip to neutral in FII DII data 17 November 2025 is significant but often ignored. Professional traders employ sophisticated strategies and their positioning changes provide valuable insights into expected volatility regimes and probability distributions.

Mistake 5: Trading Absolute Numbers vs Changes Static FII DII data 17 November 2025 figures matter less than daily deltas. FII reducing longs by 0.46L signals changing conviction despite maintaining 13.83L net long. Focus on position changes more than absolute levels.

Mistake 6: Forgetting Market Context The FII DII data 17 November 2025 exists within broader market conditions. Global events, earnings seasons, economic data releases, geopolitical developments, and policy decisions all influence how institutional positioning translates into actual price movements.

Mistake 7: Overweighting Single-Day Data One day’s FII DII data 17 November 2025 provides a snapshot, not a complete picture. Sustainable trends emerge from 5-10 sessions of consistent positioning changes. Single-day spikes or drops often reverse quickly without follow-through.

FAQ: Understanding FII DII Data 17 November 2025

Q1: What does FII DII data 17 November 2025 tell us about immediate market direction?

The FII DII data 17 November 2025 presents mixed directional signals rather than clear consensus. Retail surged bullish (+2.08L), FII booked profits (-0.46L), DII stayed bearish (-45.79L), and Pro went neutral. This divergence suggests increased consolidation probability rather than strong directional conviction. Traders should wait for clearer alignment before aggressive directional bets.

Q2: Why did clients add aggressively in FII DII data 17 November 2025?

Client accumulation in the FII DII data 17 November 2025 likely reflects retail optimism after weekend analysis or response to recent market resilience. The 2.08L addition could also represent fresh positioning ahead of anticipated events. However, retail positioning often exhibits recency bias, buying strength rather than weakness, which creates reversal risk.

Q3: How should I interpret FII profit-booking in FII DII data 17 November 2025?

FII reducing longs in the FII DII data 17 November 2025 by 0.46L suggests tactical profit-booking rather than bearish reversal. FII still maintains 13.83L net long, indicating underlying bullish bias persists. This profit-taking could create short-term consolidation opportunities before potential continuation if FII resumes accumulation.

Q4: Does FII DII data 17 November 2025 suggest DII will cover shorts?

The FII DII data 17 November 2025 shows DII shorts essentially unchanged at 45.79L, suggesting no imminent covering plans. DII typically maintains hedges throughout market cycles, adjusting based on equity portfolio value changes. Short covering signals would appear as daily reductions exceeding 2-3L consistently across multiple sessions.

Q5: How can I use FII DII data 17 November 2025 for options trading?

The FII DII data 17 November 2025 reveals massive institutional positioning across option strikes. Focus on strikes where institutional open interest concentrates—these act as price magnets. With Pro traders neutral, consider selling premium through short strangles or iron condors at strikes beyond institutional concentration zones. Monitor daily OI changes to adjust positions as institutional positioning shifts.

Final Takeaway from FII DII Data 17 November 2025

The FII DII data 17 November 2025 presents a fascinating market setup characterized by aggressive retail accumulation, FII profit-booking, persistent DII hedging, and Pro neutrality. This multi-directional positioning in the FII DII data 17 November 2025 creates both opportunity and complexity for active traders.

The standout feature of FII DII data 17 November 2025 is the retail surge adding 2.08L longs despite weekend uncertainties and FII profit-booking. This retail conviction could either fuel continuation if validated or create sharp reversals if tested. Meanwhile, the unchanged DII 45.79L short position continues providing structural resistance.

Smart traders will closely monitor how the FII DII data 17 November 2025 dynamics evolve over coming sessions. Significant position changes from any major participant could signal the beginning of strong directional moves. The current standoff suggests employing defined-risk strategies with smaller position sizes until clearer directional consensus emerges.

The primary lesson from FII DII data 17 November 2025 is that institutional positioning provides valuable context but requires integration with price action, volume analysis, and robust risk management. Use today’s FII DII data 17 November 2025 insights to inform trading decisions while maintaining discipline, proper position sizing, and predefined exit strategies.

For comprehensive daily updates on institutional positioning, bookmark this FII DII data 17 November 2025 analysis and return tomorrow for the next session’s complete breakdown. Consistent monitoring of these patterns over weeks and months builds the institutional insight edge that separates successful traders from the crowd.

Internal Links (15 Suggested Anchor Texts):

Related Searches:

- FII DII data 17 November 2025 live updates

- FII DII data 17 November 2025 Nifty analysis

- FII DII data 17 November 2025 BankNifty outlook

- How to trade using FII DII data 17 November 2025

- FII DII data 17 November 2025 chart interpretation

- Latest FII DII data 17 November 2025 NSE official

- FII DII data 17 November 2025 detailed breakdown

- FII DII data 17 November 2025 trading strategies

The analysis captures today’s key story: retail conviction surging with +2.08L adds, FII booking profits, DII maintaining defensive stance, and Pro going neutral—creating a complex multi-directional setup for traders to navigate carefully!