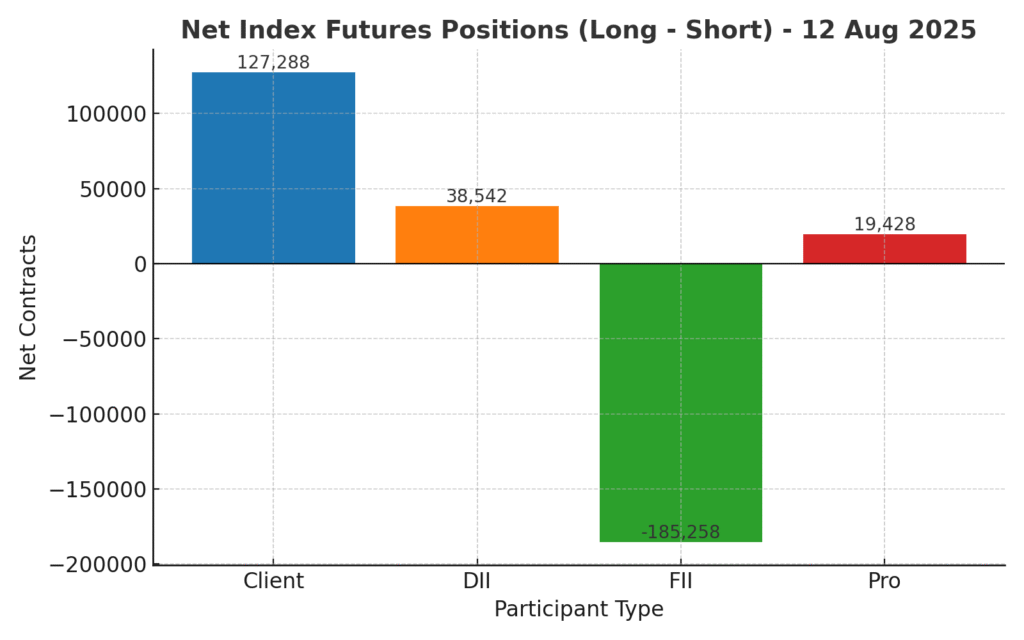

The FII DII data 12 August 2025 reveals a sharp divide between foreign institutional investors (FIIs) and retail traders (Clients) in the index futures market. While FIIs have significantly increased their short positions, retail participants are aggressively building longs. This clash could set the stage for heightened volatility in the next trading session.

FII DII Data 12 August 2025: Who Did What?

Index Futures Net Positions (Long – Short):

- Client (Retail): +127,288 contracts (Net Long)

- DII (Domestic Institutions): +38,542 contracts (Net Long)

- FII (Foreign Institutions): −185,258 contracts (Net Short)

- Pro (Proprietary Traders): +19,428 contracts (Net Long)

Decoding the Smart Money: FII & Pro Activity

FIIs:

FIIs have taken a strong net short stance in index futures with −185K contracts. In the options segment, they hold more long puts (512,828) than long calls (356,179) while also shorting calls (443,340) — a combination suggesting a bearish or hedged outlook. This aligns with a cautious to negative bias for the near term.

Pros:

Proprietary traders (the so-called “sharp money”) have maintained a modest net long position in index futures (+19K). However, their options book shows significant call writing (1.14M short calls) alongside put writing (809K short puts), signaling a neutral-to-slightly-bullish stance, likely expecting range-bound action.

The Institutional & Retail Picture: DII & Client Positions

DIIs:

Domestic institutions are net long in index futures (+38K), often playing a stabilizing role in volatile sessions. Their stock futures book is heavily short (4.15M), indicating stock-specific hedging rather than broad bullishness.

Clients (Retail):

Retail traders are strongly net long in index futures (+127K) and have loaded up on call options (2.95M long calls vs. 2.86M short calls). This optimism stands in direct contrast to the FIIs’ bearish stance — a classic setup for a volatility spike if one side is proven wrong.

For beginners wondering what is FII DII data, our ultimate guide explains everything.

The Key Takeaway for Today’s Market

The FII DII data 12 August 2025 paints a clear picture of FIIs vs. Retail. FIIs are betting on downside or at least protecting against it, while retail is chasing the upside. With Pros positioned cautiously long and DIIs providing support, the market may witness sharp swings if any sudden trigger shifts sentiment. Traders should brace for intraday volatility and keep stop-losses tight.

This data is sourced directly from the National Stock Exchange (NSE).

A bar chart comparing the net index futures positions (Long – Short) for FII, DII, Pro, and Client on 12 Aug 2025.