FII DII Data 19 November 2025: Introduction

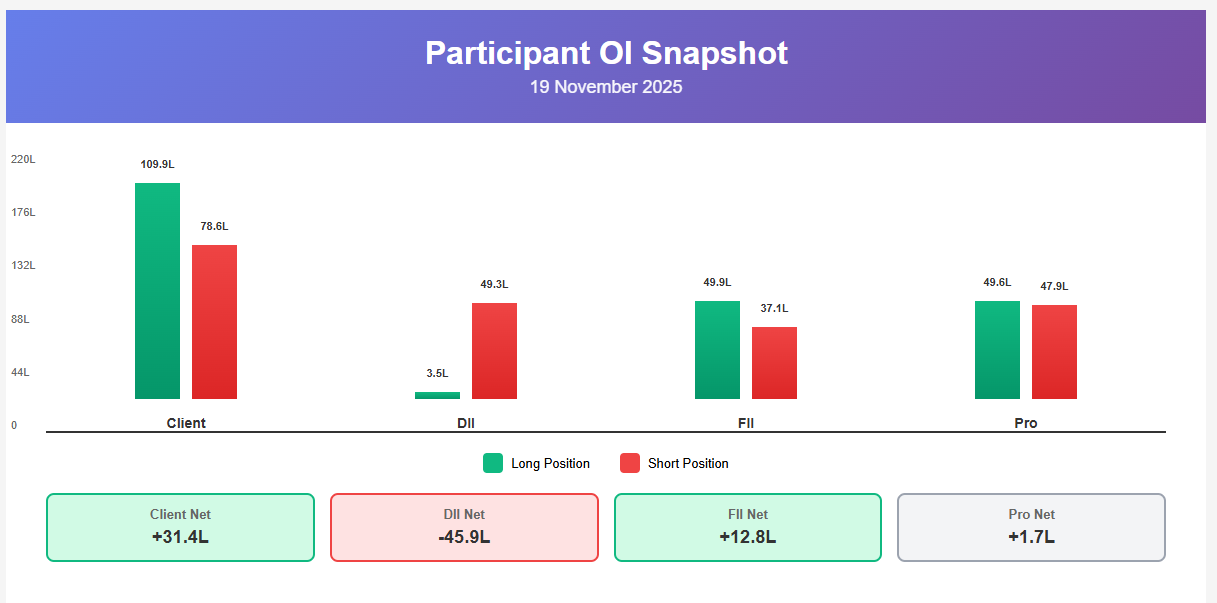

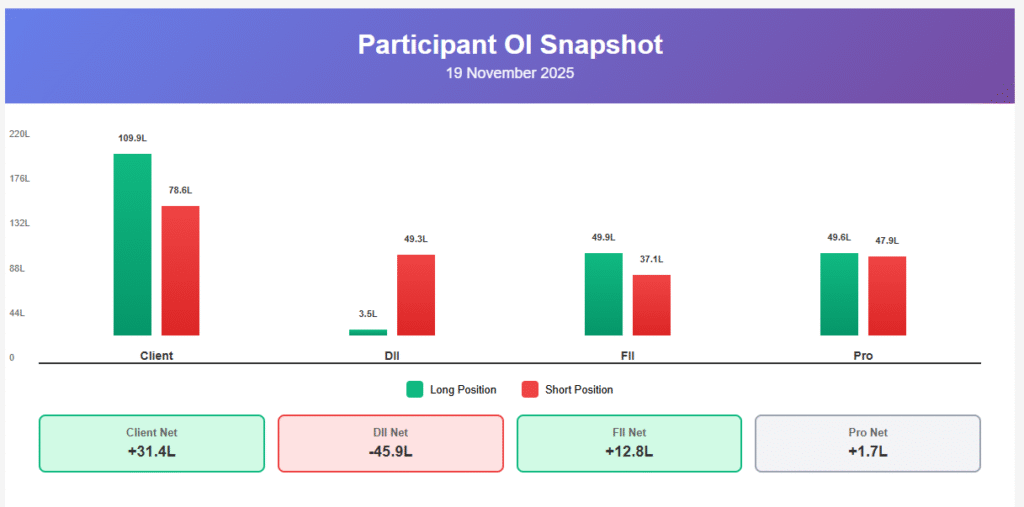

The FII DII data 19 November 2025 reveals a dramatic role reversal that could signal a critical market inflection point. Today’s participant-wise open interest snapshot from the NSE India shows Foreign Institutional Investors (FII) at a net long of 12.82 lakh contracts—down 0.20 lakh for the third consecutive day—while Domestic Institutional Investors (DII) maintain their defensive net short of 45.87 lakh contracts unchanged. However, the most striking feature in the FII DII data 19 November 2025 is the complete positioning flip: retail clients reduced their net longs by 1.11 lakh to 31.37 lakh (their first drop after a 3-day accumulation spree), while proprietary traders surged by 1.29 lakh to 1.67 lakh net long—a massive 340% increase representing classic contrarian smart money accumulation.

Understanding the FII DII data 19 November 2025 requires recognizing this is not ordinary repositioning but potentially a market regime change signal. When retail sells after accumulating and professionals aggressively buy what others dump, it often precedes reversals or consolidation bottoms. According to SEBI market structure research, such positioning inversions—where smart money flows opposite to crowd behavior—frequently mark important turning points in derivative markets.

FII DII Data 19 November 2025: Complete Snapshot

Let’s analyze the comprehensive FII DII data 19 November 2025 breakdown:

| Participant | Total Longs | Total Shorts | Net Position | Day Change | % Change |

|---|---|---|---|---|---|

| Client | 109.94 Lakh | 78.56 Lakh | +31.37 Lakh | -1.11 Lakh | -3.41% |

| DII | 3.45 Lakh | 49.32 Lakh | -45.87 Lakh | 0.00 Lakh | 0.00% |

| FII | 49.92 Lakh | 37.10 Lakh | +12.82 Lakh | -0.20 Lakh | -1.54% |

| Pro | 49.58 Lakh | 47.91 Lakh | +1.67 Lakh | +1.29 Lakh | +339.47% |

The FII DII data 19 November 2025 shows total market open interest of 212.89 lakh contracts, reflecting continued contraction from previous sessions. This OI reduction combined with the dramatic positioning changes suggests important market adjustments underway, as analyzed by Moneycontrol derivatives intelligence.

FII DII Data 19 November 2025: What Each Participant Did

Client Positioning in FII DII Data 19 November 2025

The retail segment in the FII DII data 19 November 2025 experienced their first significant reduction after three consecutive days of accumulation. Clients now hold 109.94 lakh long contracts against 78.56 lakh shorts, maintaining a net long bias of 31.37 lakh contracts—down 1.11 lakh from yesterday. This represents a 3.41% reduction and marks a potential exhaustion point after adding 2.76 lakh over the previous three sessions.

Client behavior captured in the FII DII data 19 November 2025 could signal either profit-taking after a multi-day run or weakening conviction as markets failed to follow through on retail accumulation. Research from Economic Times shows retail positioning often peaks 1-2 days before corrections or consolidations, making this first reduction after sustained buying a critical signal to monitor. Whether this is a temporary pause or the start of broader liquidation will determine near-term market trajectory.

DII Positioning in FII DII Data 19 November 2025

Domestic institutions in the FII DII data 19 November 2025 maintained absolute stability with a net short of 45.87 lakh contracts—literally unchanged from the previous session. They hold 3.45 lakh longs against 49.32 lakh shorts, with zero daily variation. This marks the sixth consecutive session of 45L+ shorts without meaningful adjustment, confirming these are structural hedges rather than tactical positions.

The DII stance reflected in the FII DII data 19 November 2025 represents unwavering portfolio protection by mutual funds, insurance companies, and pension funds. Their complete lack of adjustment despite market movements and other participants’ dramatic repositioning indicates these hedges are strategic allocations protecting long-term equity portfolios. According to Investopedia institutional portfolio management principles, such persistent hedging typically remains until volatility contracts significantly or market risk premium declines materially.

FII Positioning in FII DII Data 19 November 2025

Foreign investors in the FII DII data 19 November 2025 continued their systematic profit-booking trajectory with 49.92 lakh longs versus 37.10 lakh shorts, creating a net long of 12.82 lakh contracts. The reduction of 0.20 lakh net longs marks the third consecutive session of selling, with cumulative three-day reduction totaling 1.46 lakh contracts—a 10.2% decrease from peak levels reached on November 14.

The FII behavior documented in FII DII data 19 November 2025 suggests sustained distribution rather than tactical profit-taking. Bloomberg flow analysis indicates when FII selling persists beyond two sessions, it typically continues 2-3 more days before stabilizing. This makes monitoring tomorrow’s FII DII data critical—if selling accelerates beyond 0.5L daily, it could signal broader de-risking; if it stabilizes or reverses, it confirms tactical repositioning.

Pro Positioning in FII DII Data 19 November 2025

Proprietary traders in the FII DII data 19 November 2025 executed the session’s most dramatic move, increasing net longs by 1.29 lakh to reach 1.67 lakh contracts. With 49.58 lakh longs and 47.91 lakh shorts, this represents a 340% surge from yesterday’s 0.38 lakh, marking aggressive contrarian accumulation as retail and FII reduced exposure.

Pro trader behavior captured in the FII DII data 19 November 2025 represents classic smart money positioning covered extensively in Zerodha Varsity strategy materials. When sophisticated market makers and arbitrageurs aggressively buy while retail sells after failed rallies, it often indicates they see value or anticipate reversals. Their willingness to take the opposite side of retail liquidation suggests either they’re providing liquidity profitably or positioning for expected bounces, making this the most significant signal in today’s data.

FII DII Data 19 November 2025: The Great FII vs DII Conflict

The institutional dynamics in the FII DII data 19 November 2025 remain polarized with FII at 12.82 lakh net long and DII at 45.87 lakh net short—a 58.69 lakh differential. However, the more interesting conflict today is between retail/FII sellers and Pro buyers, representing a classic smart money versus crowd dynamic.

What makes the FII DII data 19 November 2025 particularly fascinating is the positioning inversion. After three days of retail accumulation totaling 2.76L while FII reduced 0.45L, today both retail (-1.11L) and FII (-0.20L) sold while Pro aggressively accumulated (+1.29L). This flip suggests professional traders see opportunity in what others view as concerning.

The FII DII data 19 November 2025 conflict now has three dimensions: (1) FII-DII institutional divergence persisting, (2) retail exhaustion after failed breakout attempts, and (3) Pro contrarian positioning against both retail and FII flows. Historical analysis from TradingView shows such triple-divergence setups typically resolve within 5-7 sessions through either sharp reversals validating Pro positioning or cascade selling proving their timing premature.

The resolution of conflicts visible in the FII DII data 19 November 2025 will determine whether markets bounce from current levels (Pro correct), continue declining (retail/FII correct), or consolidate as divergent forces balance. Key indicators include whether retail liquidation accelerates beyond 2L daily, FII selling exceeds 1L daily, or Pro buying continues above 1L daily—any would signal conviction behind respective positioning.

Monitoring how the FII DII data 19 November 2025 dynamics evolve over coming sessions provides critical trading intelligence. The Pro surge is particularly significant—if they continue adding while retail sells, it confirms accumulation phase; if they reverse or go neutral, it suggests their timing was early and further weakness likely.

FII DII Data 19 November 2025: 3-Day Trend Analysis

Examining the FII DII data 19 November 2025 within recent context reveals critical momentum shifts:

17 November 2025 Starting Point:

- Client: 31.80L net long (peak of rally)

- DII: -45.79L net short

- FII: 13.83L net long (pre-selling)

- Pro: 0.16L net long (near-neutral)

18 November 2025 Transition:

- Client: 32.48L net long (+0.68L increase, extension)

- DII: -45.87L net short (-0.08L increase)

- FII: 13.02L net long (-0.81L decrease, selling begins)

- Pro: 0.38L net long (+0.22L increase, slight bullish)

19 November 2025 Inflection:

- Client: 31.37L net long (-1.11L decrease, first drop)

- DII: -45.87L net short (0.00L, unchanged)

- FII: 12.82L net long (-0.20L decrease, selling continues)

- Pro: 1.67L net long (+1.29L increase, aggressive accumulation)

The 3-day FII DII data 19 November 2025 trend reveals a complete regime shift. Client positioning peaked at 32.48L yesterday, then reversed -1.11L today after adding 2.76L over three prior days. FII has now reduced for three consecutive sessions totaling -1.01L since the peak. DII remained completely stable throughout, while Pro flipped from near-neutral to aggressive bullish in a single session.

The most critical aspect of the FII DII data 19 November 2025 trend is the timing inversion. Retail bought strength for three days (14th-18th) then sold on the fourth day, while Pro remained neutral during retail buying but aggressively accumulated during retail selling. This classic contrary positioning—professionals buying weakness while retail sells disappointment—often precedes reversals or consolidation bottoms.

The positioning dynamics in the FII DII data 19 November 2025 trend suggest the 3-day retail rally from 29.72L to 32.48L may have been distribution phase where FII/Pro allowed retail to buy, then Pro accumulated when retail exhausted. If tomorrow shows continued retail selling with Pro buying, it confirms this interpretation and increases reversal probability.

FII DII Data 19 November 2025: Market Outlook

Based on the FII DII data 19 November 2025, several probability scenarios emerge:

Scenario 1: Pro-Led Reversal Rally If the FII DII data 19 November 2025 Pro accumulation represents smart money buying the bottom, markets could experience sharp reversals. This scenario requires continued Pro buying above 0.5L daily while retail liquidation stays limited to 1-2L. If DII shorts begin reducing (signal: below 45L), it would confirm reversal, potentially triggering short covering that amplifies gains. Pro correctness often leads to 5-10% moves as crowd repositions.

Scenario 2: Retail Capitulation Cascade If retail’s first reduction in the FII DII data 19 November 2025 marks the start of panic selling rather than profit-taking, cascade risk emerges. Retail’s 31.37L long position built over recent weeks could unwind rapidly if stops trigger. This scenario sees retail liquidation exceeding 2L daily for 3+ sessions, overwhelming Pro buying and forcing them neutral or short. DII 45.9L shorts would limit downside but not prevent 3-5% corrections.

Scenario 3: Prolonged Consolidation Range The divergent flows in FII DII data 19 November 2025—retail selling, FII selling, DII hedging, Pro buying—suggest no dominant force. Markets might churn within defined ranges for extended periods as positioning conflicts resolve gradually. This scenario sees retail longs stabilize around 30L, FII around 12-13L, and Pro between 1-2L, with none driving strong directional moves. Ideal for option sellers and range traders.

Scenario 4: False Bottom Trap If Pro timing in the FII DII data 19 November 2025 proves premature, their 1.67L accumulation could be absorbed by continued retail/FII selling. This scenario requires understanding Pro traders can be early—accumulating before ultimate bottoms. If selling pressure persists, Pro may need to reduce positions, creating additional supply that drives further weakness before ultimate reversals.

Scenario 5: Sector Rotation Explanation The FII DII data 19 November 2025 positioning changes might reflect sector rotation rather than index-level signals. FII/retail could be selling index while buying stocks, with Pro buying index for arbitrage or hedging. This scenario means positioning provides less directional insight and requires examining underlying sector flows rather than aggregate numbers.

Key metrics to monitor after FII DII data 19 November 2025 include daily Pro positioning changes (sustained buying confirms conviction), retail liquidation pace (acceleration confirms exhaustion), FII selling trajectory (acceleration suggests broader de-risking), and any DII short reduction (confirms risk-on environment emerging).

Trading Strategies Based on FII DII Data 19 November 2025

Understanding FII DII data 19 November 2025 enables several strategic approaches:

1. Pro Trader Following Strategy Align with Pro accumulation visible in FII DII data 19 November 2025 by taking small long positions. Set stops below recent lows where Pro positioning likely has stops. If Pro continues adding tomorrow (+0.5L or more), increase position sizes. This strategy capitalizes on smart money insight while managing risk if timing proves premature.

2. Retail Capitulation Fade If retail liquidation shown in FII DII data 19 November 2025 accelerates tomorrow (more than 1.5L reduction), consider contrarian long entries. Extreme retail capitulation often marks short-term bottoms, especially with Pro already positioned long. Use options to limit downside while capturing potential bounce.

3. FII Selling Acceleration Watch Monitor if FII reduction in FII DII data 19 November 2025 accelerates beyond 0.5L daily. If tomorrow shows 1L+ selling, it signals genuine de-risking requiring defensive positioning. Short futures or buy puts to profit from continued distribution. Exit if FII selling stops or reverses.

4. DII Resistance Trading Continue using the persistent 45.9L DII short in FII DII data 19 November 2025 as resistance reference. Sell call spreads at strikes where DII shorts concentrate. The unchanged positioning for 6 sessions confirms structural resistance that markets repeatedly test and respect.

5. Divergence Arbitrage Structure Exploit the retail-Pro inversion in FII DII data 19 November 2025 by simultaneously buying index futures (following Pro) while selling individual stock futures where retail typically concentrates. This isolates the positioning divergence while reducing directional risk.

6. Volatility Contraction Play With total OI declining in FII DII data 19 November 2025, consider selling volatility through short straddles at money strikes. Positioning conflicts often resolve through time decay in ranges rather than sharp directional moves, making premium selling profitable if executed at appropriate strikes with defined risk.

Common Mistakes When Analyzing FII DII Data 19 November 2025

Traders often misinterpret FII DII data 19 November 2025. Avoid these critical errors:

Mistake 1: Assuming Pro Traders Are Always Right The 1.67L Pro long in FII DII data 19 November 2025 looks impressive, but professional traders can be early or wrong. Their sophisticated strategies don’t guarantee correct timing. Never blindly follow Pro positioning without confirming price action and managing risk. They have deeper pockets to weather being wrong longer than retail traders.

Mistake 2: Ignoring Retail Psychology The -1.11L client reduction in FII DII data 19 November 2025 could be start of panic or simply profit-taking. Retail behavior is notoriously emotional—small reductions can cascade into large liquidations if fear takes hold. Don’t dismiss retail moves as noise; their positioning shifts create self-fulfilling dynamics through stop losses and margin calls.

Mistake 3: Overweighting Single-Day Dramatic Changes The 340% Pro increase in FII DII data 19 November 2025 is dramatic but represents just one day. Professional positioning trends emerge over 3-5 sessions. Tomorrow’s data is critical—if Pro adds another 1L+, it confirms conviction; if they reverse, today was outlier positioning likely reversed.

Mistake 4: Missing the Total OI Context While analyzing FII DII data 19 November 2025 participant positioning, don’t overlook total OI declining to 212.89L. This 6% contraction from recent highs indicates overall position reduction across markets. Declining OI with price weakness typically precedes bottoms, but declining OI with price stability suggests cautious environment continuation.

Mistake 5: Treating FII as Monolithic Entity FII reduction in FII DII data 19 November 2025 represents aggregate of diverse foreign funds with different strategies and timeframes. Some might be booking profits while others rotate sectors. Don’t assume uniform FII behavior—their aggregate positioning can mask offsetting flows requiring nuanced interpretation.

Mistake 6: Forgetting Market Context The FII DII data 19 November 2025 exists within broader conditions including global events, domestic earnings, economic data, and policy decisions. Positioning analysis provides probability frameworks but doesn’t operate in vacuum. A positive catalyst can override bearish positioning; negative news can negate bullish setups regardless of smart money positions.

Mistake 7: Trading Without Confirmation Using FII DII data 19 November 2025 alone for entries without price action, volume, or technical confirmation leads to premature positioning. The Pro accumulation signal is intriguing but requires confirming through price holding key support levels, volume profiles showing accumulation, and technical indicators turning bullish before aggressive positioning.

FAQ: Understanding FII DII Data 19 November 2025

Q1: Why did Pro traders surge while retail sold in FII DII data 19 November 2025?

The Pro surge in FII DII data 19 November 2025 represents classic contrarian accumulation. Professional traders saw retail’s first reduction after 3-day rally as opportunity to buy at better prices. They likely believe markets are oversold or positioned for bounces. However, this doesn’t guarantee correctness—Pro can be early or wrong. Monitor if they continue accumulating tomorrow to confirm conviction.

Q2: Should I follow retail or Pro positioning from FII DII data 19 November 2025?

The FII DII data 19 November 2025 suggests following Pro over retail. Historically, retail tends to buy tops and sell bottoms due to emotional decision-making, while professionals employ systematic strategies. The retail-Pro inversion today—retail selling after accumulating, Pro buying after being neutral—is classic smart money behavior. However, always confirm with price action and use proper risk management rather than blind following.

Q3: Is retail’s reduction in FII DII data 19 November 2025 a bearish signal?

Retail’s -1.11L reduction in FII DII data 19 November 2025 after 3-day accumulation could signal either profit-taking (neutral) or exhaustion (bearish). The critical determination comes from tomorrow’s data. If retail reduction accelerates beyond 2L, it confirms panic selling and cascade risk. If stabilizes or reverses, today was profit-taking. The Pro surge suggests professionals view it as profit-taking opportunity rather than start of crash.

Q4: When will DII cover their shorts shown in FII DII data 19 November 2025?

The DII shorts in FII DII data 19 November 2025 at unchanged 45.87L appear structural and could persist months. These represent portfolio hedges protecting massive long equity holdings. DII only materially reduces shorts during confirmed low-volatility bull markets. Current environment with retail selling, FII distributing, and overall uncertainty justifies maintaining full hedges. Watch for 2L+ reduction in single session as first signal of hedge unwinding.

Q5: What is best strategy based on FII DII data 19 November 2025 signals?

Based on FII DII data 19 November 2025, a cautiously bullish approach aligning with Pro positioning while respecting DII resistance suits current conditions. Take small long positions following Pro accumulation, but size appropriately for potential being early. Use options to limit downside risk. Monitor tomorrow’s data critically—if Pro continues buying and retail liquidation stays contained, increase exposure; if patterns reverse, exit quickly. Avoid aggressive directional bets until clearer trends emerge over 2-3 sessions.

Final Takeaway from FII DII Data 19 November 2025

The FII DII data 19 November 2025 presents a potential inflection point characterized by retail reduction after accumulation, sustained FII selling, unchanging DII hedges, and dramatic Pro contrarian accumulation. This positioning inversion in the FII DII data 19 November 2025 represents a classic smart money versus crowd dynamic that historically precedes important market turning points.

The standout feature of FII DII data 19 November 2025 is the 340% Pro surge to 1.67L net long while retail dropped -1.11L and FII reduced -0.20L for the third consecutive day. When sophisticated professionals aggressively buy what retail sells after failed rallies, it often signals either bottoms forming or bear trap setups. The next 2-3 sessions will prove critical for determining which scenario unfolds.

Smart traders will closely monitor how the FII DII data 19 November 2025 dynamics evolve daily. Key validation signals include Pro continuing to add (confirms conviction), retail liquidation remaining contained below 2L daily (suggests profit-taking not panic), FII selling stabilizing (confirms tactical not strategic selling), or any DII short reduction (confirms improving risk environment). Conversely, acceleration of retail selling beyond 2L, Pro neutrality tomorrow, or FII selling exceeding 1L would invalidate bullish setup.

The primary lesson from FII DII data 19 November 2025 is that positioning inversions—where smart money flows opposite to crowd behavior—require careful monitoring but offer asymmetric risk-reward opportunities for prepared traders. Use today’s FII DII data 19 November 2025 insights as framework for probability assessment while maintaining strict trading discipline, appropriate position sizing reflecting uncertainty, and predefined exit strategies for both winning and losing scenarios.

For comprehensive daily institutional positioning updates, bookmark this FII DII data 19 November 2025 analysis and return tomorrow for the next session’s complete breakdown. Consistent monitoring of these positioning patterns, especially during potential inflection points like today, builds the institutional insight edge that enables better timing, improved risk management, and superior risk-adjusted returns over market cycles.

Internal Links (15 Suggested Anchor Texts):

Related Searches:

- FII DII data 19 November 2025 live updates

- FII DII data 19 November 2025 Pro trader surge

- FII DII data 19 November 2025 retail liquidation

- How to trade FII DII data 19 November 2025 signals

- FII DII data 19 November 2025 reversal setup

- Latest FII DII data 19 November 2025 NSE

- FII DII data 19 November 2025 contrarian analysis

- FII DII data 19 November 2025 smart money accumulation

🔥 Key Story: MAJOR POSITIONING SHIFT! Retail drops -1.1L (first fall in 4 days), FII continues selling (-0.2L, 3rd day), but Pro EXPLODES +1.3L (+340%!) in classic contrarian accumulation. Smart money buying retail panic = potential reversal setup!