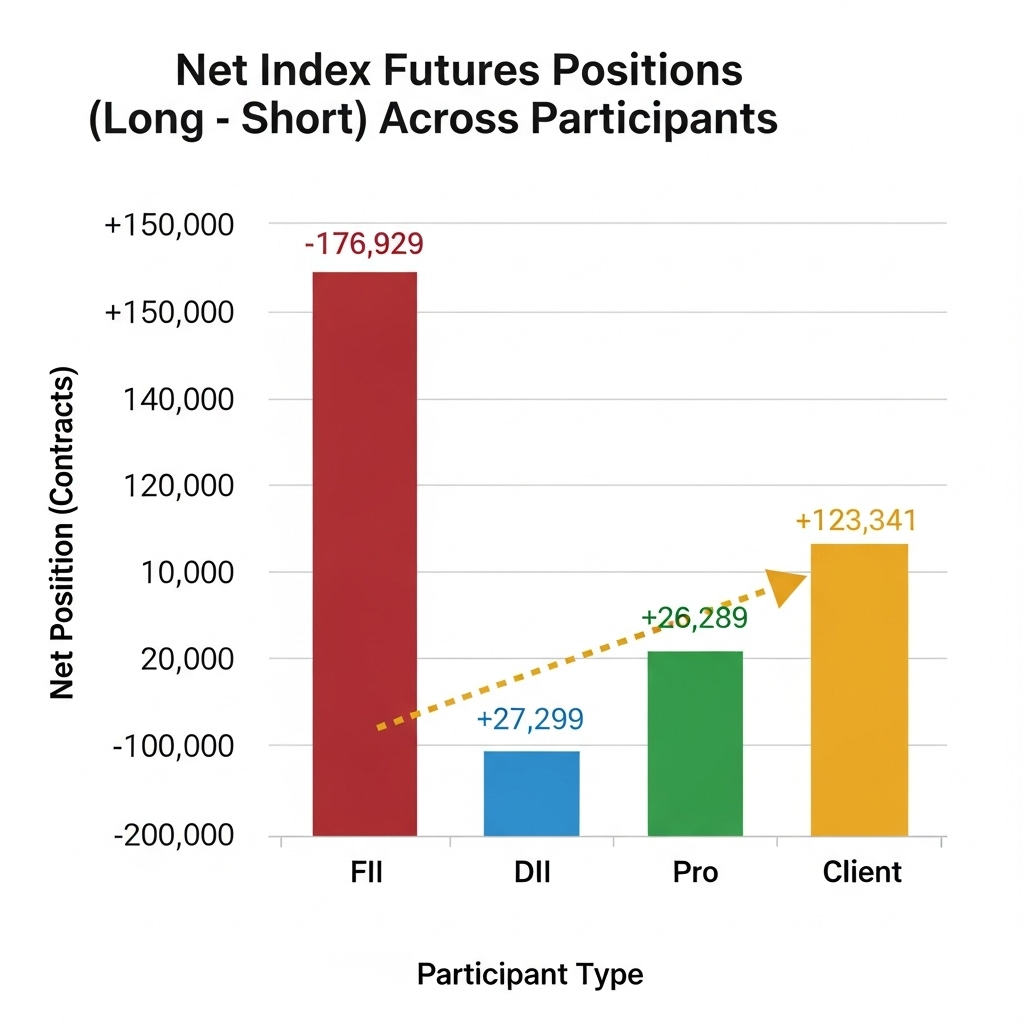

FII DII data 26 August 2025 reveals a clear divergence: Clients are aggressively long in index and stock futures, while FIIs lean bullish via options rather than futures. This smart-money vs. retail split is today’s core narrative and could set up a volatility pocket for the next session. We’ll unpack where FIIs, DIIs, Pros, and Clients took their biggest swings—and what it signals.

FII DII Data 26 August 2025: Who Did What?

- FII: Index Futures net −176,929; Index Options net +238,622; Stock Futures net +1,358,597; Stock Options net +41,781

- DII: Index Futures net +27,299; Index Options net +45,224; Stock Futures net −3,974,216; Stock Options net −208,195

- Pro (Prop): Index Futures net +26,289; Index Options net +144,142; Stock Futures net +370,839; Stock Options net −177,538

- Client (Retail): Index Futures net +123,341; Index Options net −427,986; Stock Futures net +2,244,780; Stock Options net +343,952

Decoding the Smart Money: FII & Pro Activity

FIIs: Despite a net short in Index Futures, FIIs are net long in Index Options, hinting at a preference for convexity—participating on the upside while controlling downside via structured option exposure. Their strong net long in Stock Futures (+1.36M) suggests selective stock-level bullishness rather than broad index beta. Overall, FIIs look cautiously bullish with hedges, not outright risk-on.

Pros (Proprietary Traders): Props are net long Index Futures and Index Options, echoing FIIs’ tilt but with net short in Stock Options, likely premium-selling to monetize elevated implieds. As the “sharp money,” their alignment with FIIs on the index—long delta with option overlays—adds credence to a measured bullish bias rather than a euphoric chase.

The Institutional & Retail Picture: DII & Client Positions

DIIs: Classic counter-cyclical behavior: net short Stock Futures (−3.97M), likely providing liquidity and hedging cash books. Lightly net long Index Futures and Index Options, they’re not fighting the tape on the index but remain defensive at the stock level.

Clients (Retail): The standout: heavy longs in Stock Futures (+2.24M) and Index Futures (+123k), but net short Index Options (−427,986)—often a sign of short-premium strategies that can be vulnerable to a quick volatility spike. This sets up a major standoff with FIIs/Pros who prefer optionality over naked futures exposure.

For beginners wondering what is FII DII data, our ultimate guide explains everything.

This data is sourced directly from the National Stock Exchange (NSE).

The Key Takeaway for Today’s Market

Pro Insight: Today’s FII DII data 26 August 2025 frames a classic FIIs/Pros (hedged long) vs. Clients (futures-heavy long) setup. If volatility expands, Clients’ short-options book could feel the pinch, while FIIs/Pros benefit from convexity. Near-term bias tilts slightly bullish with whipsaws, not a clean one-way trend. Watch for gap risk and option-led swings into the next session; sustaining upside likely requires follow-through in index breadth and no negative macro surprises.